Introduced in 2016, Unified Payments Interface (UPI) plays a vital role in enabling digital payments in India. UPI apps have helped Indians make cashless transactions – an aspect that changed from merely a luxury to a necessity during the coronavirus pandemic. If you’re planning to start using UPI apps or are wondering if there are UPI apps that offer better features and experience, here are the top UPI apps you can use in India right now.

Best UPI Apps in India (2021)

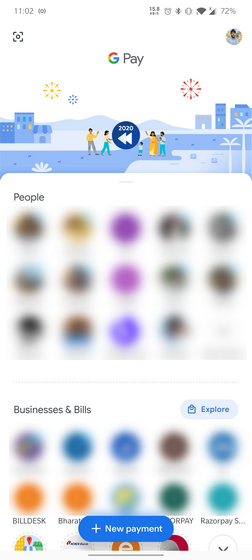

1. Google Pay

Google Pay started off as an India-first mobile payments app ‘Tez’ and eventually got rebranded. According to NPCI’s latest figures, the platform processed 854.49 million customer transactions worth Rs.1,76,199.33 crores in December. You can use Google Pay for sending and receiving money from friends & family, mobile recharge, bill payments, and more.

In addition, from the Business section of Google Pay, you can utilize mini-apps for food delivery, travel booking, toll payments, and shopping to name a few. The app also offers cashback through scratch cards for transactions. The disadvantage I found when it comes to Google Pay is that you can’t opt out of in-app events or separately disable promotion notifications, which can get annoying at times.

In addition, from the Business section of Google Pay, you can utilize mini-apps for food delivery, travel booking, toll payments, and shopping to name a few. The app also offers cashback through scratch cards for transactions. The disadvantage I found when it comes to Google Pay is that you can’t opt out of in-app events or separately disable promotion notifications, which can get annoying at times.

Pros:

- Clean UI with no in-app third-party intrusive ads

- QR code payments

- Screen Lock for security

- Mobile Recharge, DTH & Electricity Bills

Cons:

- Intrusive in-app events with no option to opt-out (Eg. Diwali stickers, Go India)

- Promotion notifications without an option to disable

- Unreliable at times

- No wallet

Download Google Pay (Android | iOS)

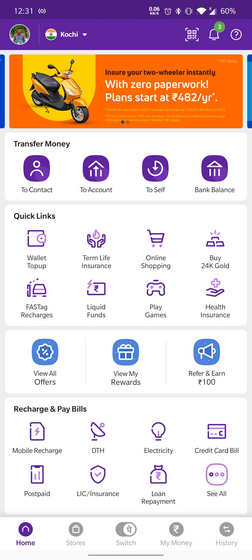

2. PhonePe

PhonePe is one of the best UPI payment apps you can use in India. In fact, PhonePe surpassed Google Pay in terms of transactions in December. According to NPCI, the app witnessed 902.03 million transactions worth Rs. 1,82,126.88 crores. Apart from UPI payments, PhonePe helps you recharge your phone, pay credit card bills, online shopping, health insurance, and much more.

Like Google Pay, you get cashback for PhonePe transactions. What I don’t like about PhonePe is that the app is cluttered with banner ads everywhere. In addition, the interface can get overwhelming for new users.

Like Google Pay, you get cashback for PhonePe transactions. What I don’t like about PhonePe is that the app is cluttered with banner ads everywhere. In addition, the interface can get overwhelming for new users.

Pros:

- Wallet for seamless transactions

- QR code payments

- Screen Lock for security

- Mobile Recharge, DTH, Electricity Bills, Cylinder Booking, and more

Cons:

- Too many banner ads

- Slightly outdated UI

- Overwhelming UX

Download PhonePe (Android | iOS)

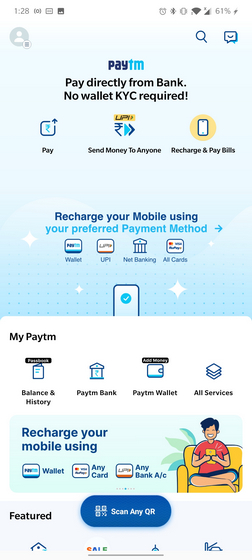

3. Paytm

If you’re living in India, you’ve probably heard of Paytm. Thanks to its market penetration strategies, Paytm is widely accepted and recognized almost everywhere in India. As a result, you won’t have any trouble making cashless payments through Paytm in the country. Paytm’s UI was absolute chaos before, but recent updates have made it tolerable with quick access to essential features.

Pros:

- Paytm Wallet

- QR code scanning

- Screen Lock for security

- Modern interface

- Mobile Recharge, DTH, Electricity Bills, Cylinder Booking, and more

Cons:

- Too many explainer banners

- Incoherent UI and UX

Download Paytm (Android | iOS)

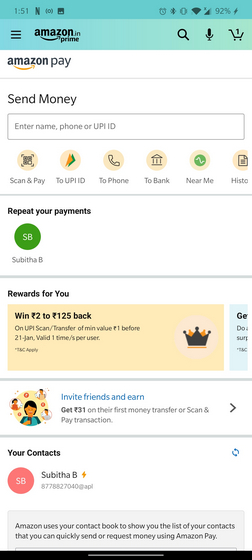

4. Amazon Pay

Although Amazon doesn’t have a dedicated Amazon Pay UPI app, you can use the UPI functionality within the Amazon Shopping app. One key advantage of Amazon Pay is the seamless integration for shopping using Amazon Pay Balance – Amazon’s digital wallet. Like other UPI apps on this list, you can use Amazon Pay to send and receive payments. You also have mobile recharge, bills, travels, insurance, gift cards, and more. Amazon Pay is one of the most rewarding apps with ample cashback and discount offers. You can access Amazon Pay from the Amazon app’s sidebar.

Pros:

- Amazon Pay Balance

- QR code scanning

- Fast UPI payments

- Mobile Recharge, Bills, Travel, Insurance, and more features

Cons:

- No dedicated app

- Not straightforward to access

- Basic interface

Download Amazon Pay (within Amazon app) (Android | iOS)

5. BHIM

If you’re looking for a straightforward app from the makers of UPI, BHIM app should be your pick. Unlike most of the other UPI apps, you can set a custom UPI of your choice on the BHIM app as long as it is not taken. Apart from this, you have standard features including sending and receiving money, bill payments, and requesting money. You can also locate nearby shops that support UPI standard from BHIM app.

Pros:

- Official app from NPCI

- Custom UPI IDs

- Screen Lock

- Locate Nearby UPI Enabled Shops

- (Relatively) Bloat-free interface

Cons:

- Not fluid – there are noticeable frame drops during navigation

- Some UI elements look outdated

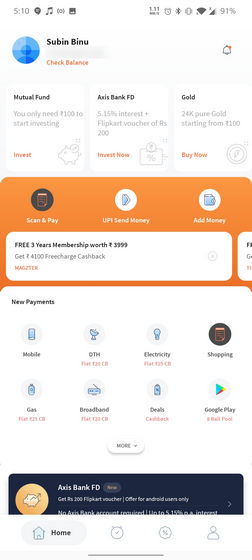

6. Freecharge

Freecharge was one of the leading payment apps in India a few years back, but its popularity is on the decline in the recent past. Don’t get me wrong, the app still managed to process 1 million transactions worth 59.9 crores in December of 2020. However, Freecharge is not as popular as it used to be. You can use Freecharge for UPI transactions, mobile and DTH recharges, Google Play top-ups, and more. The app has slight neumorphic design cues, especially in the bottom navigation bar, which elevates the overall aesthetic.

Pros:

- Clean and Visually pleasing UI

- Custom UPI ID

- Wallet

- QR Code Scanning

- Mobile, DTH, Broadband payments

Cons:

- Banner ads

Download Freecharge (Android | iOS)

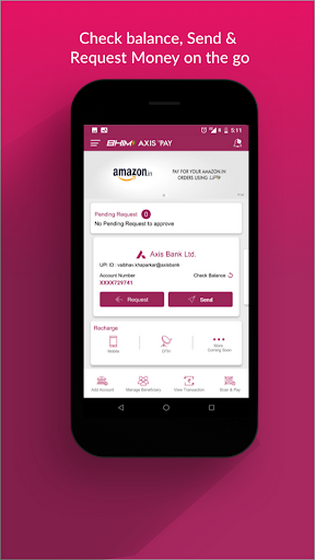

7. BHIM Axis Pay

Contrary to popular misconception, you can use Axis Bank’s BHIM Axis Pay app even if you don’t have an account in Axis Bank. Just like other UPI apps, you can download and install BHIM Axis Pay to make UPI payments. You also get additional features like online recharges, DTH recharges, credit cards (for Axis bank customers) through this app. The experience of using this app is in line with what you get with other traditional banking apps.

Pros:

- Custom UPI IDs

- QR Code Scanning

- Online recharges

- DTH recharges

Cons:

- Traditional Banking App Interface

- Setup process needs mobile network data

Download BHIM Axis Pay (Android | iOS)

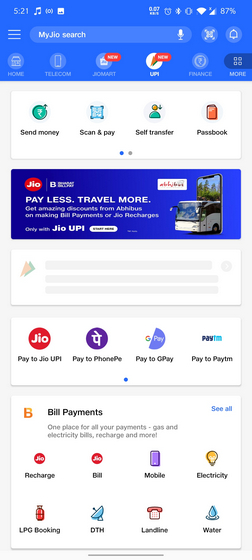

8. Jio Pay

As the name suggests, Jio Pay is the payment solution of Reliance Jio. Available within the MyJio app, Jio Pay offers UPI payments, bill payments, QR code scanning, and a passbook to keep track of your transactions. If you’re someone who uses Reliance Jio’s software offerings through MyJio app, JioPay is something you should not miss out on.

Pros:

- Bill Payments

- QR Code Scanning

- Discounts from partner services

Cons:

- No dedicated app

Download Jio Pay (within MyJio app) (Android | iOS)

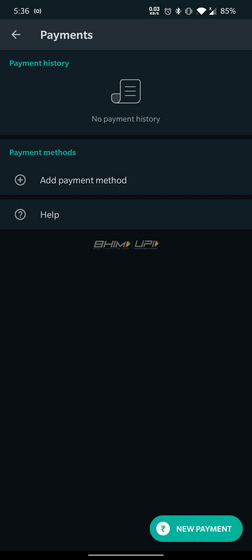

9. WhatsApp Pay

Lastly, we have the controversial WhatsApp Pay. After years of legal hurdles, WhatsApp finally managed to launch its UPI payments service in November of 2020. While the usage of WhatsApp Pay was a modest 0.31 million in November, it grew exponentially to 0.81 million in December. However, the usage further declined in January. Just when WhatsApp Pay started to expand, the company found itself in trouble over a privacy policy update that led users to move towards privacy-friendly alternatives like Signal and Telegram.

It’ll be interesting to see WhatsApp Pay’s usage figures of January to know how much the privacy policy backlash has affected the company’s ambitious UPI expansion. While I won’t recommend using WhatsApp just for its UPI payments feature, you can consider checking it out if you’re not planning to switch from the app.

It’ll be interesting to see WhatsApp Pay’s usage figures of January to know how much the privacy policy backlash has affected the company’s ambitious UPI expansion. While I won’t recommend using WhatsApp just for its UPI payments feature, you can consider checking it out if you’re not planning to switch from the app.

Pros:

- Beneficial for WhatsApp users

Cons:

- No dedicated app

- From Facebook

Download WhatsApp (Android | iOS)

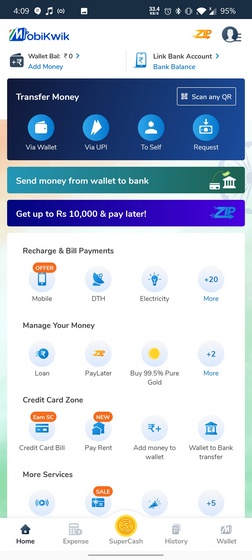

10. Mobikwik

Mobikwik is another option you can consider if you need a feature-rich UPI app. One unique aspect of Mobikwik is that you can generate UPI-powered personal payment links for seamlessly receiving money from other UPI app users. Mobikwik also offers the flexibility of recharge and bill payments, paying credit card bills, and much more. Mobikwik’s team has also packed an expense manager to help you track all your spending and get a transaction history without relying on an expense tracker app.

However, the good things about Mobikwik end there. The company was allegedly a victim of a massive data breach that compromised the data of nearly 10 crore users. That includes personal details & KYC soft copies (PAN, Aadhaar). Worst part? Mobikwik denied the claims and even went on to blame its users for the breach. If that doesn’t make sense to you, you’re not alone. If you no longer trust Mobikwik and value your privacy, find the steps to delete your Mobikwik account from our linked article and switch to one of the UPI apps mentioned above.

Pros:

- Wallet

- Expense Manager

- Personal Payment Link

- QR Scanning

- Security PIN

Cons:

- Banner ads

- Patriotic sentiment-driven app starting from the logo, splash screen, and UI background

- Possibly suffered a data breach but denies it

Download Mobikwik (Android | iOS)

Use UPI Apps for Fast Payments

So, those are the top UPI apps you can use in India. I personally find myself using Google Pay and Amazon Pay for all my UPI payment needs, but I’m inclined towards giving Freecharge another shot. Let us know the UPI app of your choice in the comments.

My view differs from you completely, several cons not mentioned in urs article. GPay has issue after every app update, Paytm tried first with its wallet and now phonepe following same. Amazon pay has innumerable failure transactions and taking time to load page. Cashback was given when user is new only . My experience with Airtel UPI is best in terms of fastest and dual safety UPI transaction, only con is there which is no cashback, but much better when in hurry.

My choice is g-pay, amazon pay and Jio Upi.

Thanks sir for write this type of articles Please you are don’t use google pay because this is American app not made in india you are use Paytm,jio pay,phonepay , airtel payment bank , any other payment app but made in india hona chahiye

I am a requested to write this article

Please make a next article made in india upi payment app

And great articles

bhai apki English dekh k pta chk gya aap American app k against kyu h 🙂

Article is very generic and needs more research. Such ranking articles need lot of careful research but nowadays authors just google and write articles based on that information.

Please consider below points:

a. Customer support service. It is very important factor on which you can rate an app. CC is slowly dying in India as low quality AI chat bits are giving resolution. Nowadays it is tough get the proper service even you give negative feedback (along with ticket number) in the play store. Here also an AI chat bot gives answers.

b. Crisis management especially muli-app-transactions.

c. App crash rate

d. Good features

e. Annoying features etc

f. Best way to write such article is use each app for some time.

Good article.

There are no cashbacks from PhonePe, they give vouchers which are commonly available elsewheras well.

Great article!

I am used Google pay and paytm is best app.and better service given this app.

I like your post.ithis is very helpful information.thank you.

Google Pay is awesome and simple

Please you are don’t use google pay because this is American app not made in india you are use Paytm,jio pay,phonepay , airtel payment bank , any other payment app but made in india hona chahiye

I am a requested to write this article

Please make a next article made in india upi payment app

And great articles

Thanks sir for write this type of articles

I used G Pay, Phone Pe, Paytm & Freecharge, But mostly i used freecharge because never fail of transaction.

Why is patriotic sentiment considered a “con”? Is there anything wrong with promoting patriotic sentiments?

Me too agree why?

Jung thodi ladne jaare tum payment krke, Kya zaroorat faltu ke advertisement gimmick ki?

Paytm is better. Hardly failed transaction

gpay, apay

Google pay requires a wallet so that it can increase its users

You’ve missed out Mi pay. Mi has many users in India, and many use Mi pay. And to be honest, Mi pay and phonepe are way better than google pay, especially the speed of the payment, and since it’s all UPI enabled it’s safe. Mi pay looks very nice too, very minimal ads.