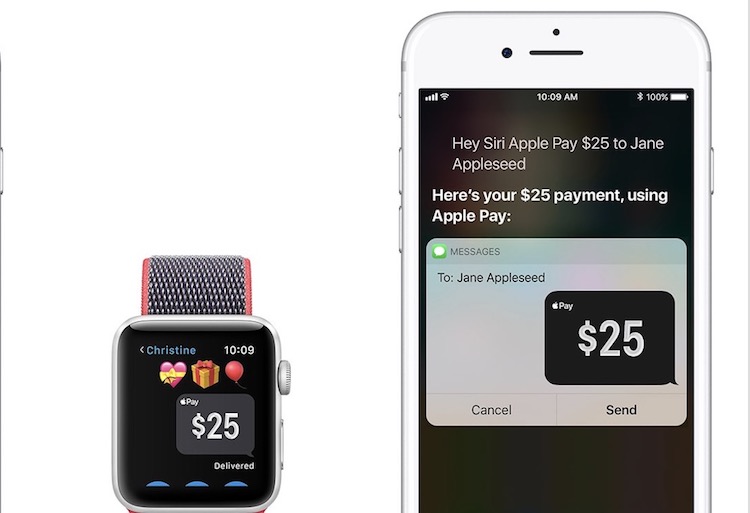

Apple’s foray into the domain of mobile payments and digital wallet service with Apple Pay has generated positive results for the company. Following the success of Apple Pay, the company launched Apple Pay Cash, a peer-to-peer payment system that lets users transfer money to friends and family members directly from iMessage. The company is now in talks with Goldman Sachs to jointly launch a credit card with the Apple Pay branding that will let customers avail in-store loans on Apple products.

According to a report from the Wall Street Journal, Apple and Goldman Sachs are currently having discussions about the launch of a credit card that could be released early next year.

Sources familiar with the new developments have revealed that Apple will end its ongoing partnership with Barclays to launch a credit card in collaboration with Goldman Sachs. Both the companies are busy chalking out the benefits and perks that will be doled out to the credit cardholders such as gift cards and interest-free financing offers on Apple products.

The partnership with Apple marks the debut of Goldman Sachs into the credit card business, however, the financial terms of the deal such as revenue sharing are yet to be finalized. WSJ’s sources added that Apple might charge a fee for each new cardholder and might also collect a percentage of the payments made using the credit card as a transaction fee. Moreover, Apple might also double the current 0.15% transaction fee it charges, if the deal with Goldman Sachs is finalized.

There is no information regarding the company that will process the transactions made using the Apple-Goldman Sachs credit card. However, Apple’s old ties with Visa indicate that the California-based company might eventually be selected over rivals such as Master Card and Discover Financial Services.