Digital payments giant Paytm already enables you to invest in mutual funds via Paytm Money but it has been planning to get into stock broking for the past six-odd months. Today, Paytm Money has bagged an important update to introduce stock trading onto its platform. It intends to rely on a completely digital (paperless) KYC process and low trading charges to attract investors to its platform.

Stock broking via Paytm Money is currently in beta testing. You can join the waitlist to gain access to the feature. I have already hopped on the waitlist but the queue is pretty long, as you can see above. The company will give only a select number of users access to stock trading at the moment. It will collect feedback and then roll out the update to everyone over the coming weeks.

The stock trading services have only been rolled out to web and Android users at the moment. iOS users will have to wait a few weeks to be able to access the stock trading feature. “With the addition of equities, Paytm Money seeks to drive financial inclusion among investors by removing information gaps and facilitating stock penetration in the country,” says Varun Sridhar, CEO – Paytm Money in an official statement.

Paytm Money: Brokerage & Account Charges

I know you are itching to learn the investment charges, so here we go. The company is taking cues from other brokerage firms and doesn’t have any Depository AMC charges. You will, however, have to shell out Rs. 300 as platform charges (applicable at Re. 1 per day when the exchange is open). The account opening charge or digital KYC charge, as Paytm Money calls it, has been set at Rs. 200.

The brokerage charge is Rs. 0.01 (basically zero rupees) when you take delivery of the shares you buy. Your intraday trades will see a “minimum of 0.05% of turnover or ₹10 when there is no debit/credit of shares in your Demat account.” You will have to pay 18% GST over the brokerage charges, along with exchange fees. Paytm Money enables you to transfer money using Netbanking (@ Rs. 10 per fund addition) and UPI (free).

Paytm Money: Stock Trading App Features

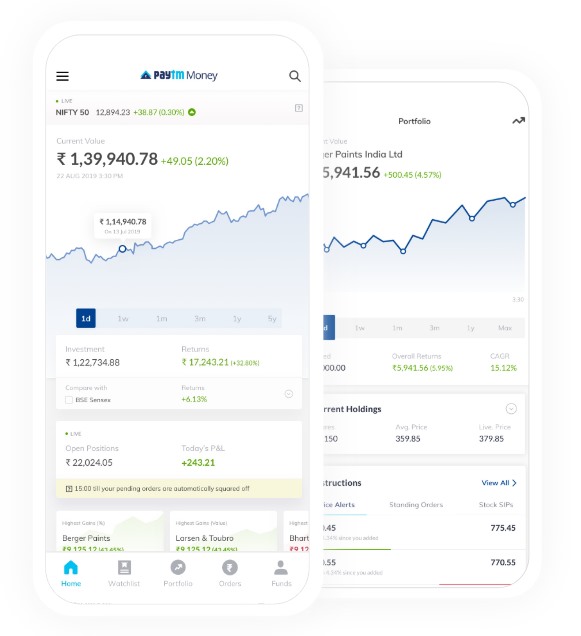

As for the features, Paytm Money will enable you to create multiple watchlists with up to 50 stocks in each. You can not only add and track real-time stock prices but set price alerts for buying or selling stocks using the platform. Alerts can also be set up for up to 50 stocks at a time.

You also get a built-in brokerage calculator and trade options for bracket and cover order, similar to Zerodha. You obviously get access to in-depth financial and historical price data for every listed company within the Paytm Money app itself. You don’t need to head to Moneycontrol or other third-party apps for this data. The platform also gives you the option to set up SIPs (weekly/monthly buy orders) to automate the investment process.

The company is also exploring the introduction of F&O investments on the app in the near future. Zerodha already offers all of the aforementioned features and more.

Paytm Money will compete against other popular online broking firms, such as Groww and Upstox in India. Zerodha is currently leading the charge in the sector though. The company has kept its trade charges really competitive but it will be interesting to see whether users trust Paytm over other established brokerage firms. If you didn’t already know, Paytm Money currently facilitates mutual funds and NPS investments for more than 6 million users.