After disrupting the electronics market in India with smartphones, TVs, and whatnot, Xiaomi has entered the financial space with two new services; Mi Pay and Mi Credit. While Mi Pay is based on UPI for payments and prepaid services, Mi Credit is for lending money. Mi Credit was announced in September last year, which was available to select MIUI users to test the market response. Now Xiaomi has launched the Mi Credit app to all Xiaomi users running MIUI. Mi Credit will allow consumers to borrow personal loan up to 1 lakh rupees instantly into their bank account, and the process is entirely digital. In this article, we are going to tell you all about Mi Credit and how you can use it get instant loan.

What is Mi Credit?

Mi Credit is a personal financing service where consumers can take a loan through their mobile phones and pay back in monthly installments. It’s just like the traditional banks, but the process is completely digital and the loan disbursement is instant. Here are the important points that you need to know about the service before using it.

- Mi Credit is a secure, instant personal loan service by Xiaomi.

- It’s available to all Xiaomi users running MIUI.

- You can take loan up to 1 lakh rupees with real-time disbursement.

- The interest rate vary from 1.3% to 2.5% per month. The maximum loan tenure is 36 months.

- You will need to provide your PAN, address proof, income source, and bank account details.

- You will have to pay the EMI by 5th of every month.

- The loan is collateral free which means you don’t have to provide any kind of security in terms of property. However, you will have to pay a processing fee to avail the loan

How to Use Mi Credit

1. Open Mi Apps on your Xiaomi device and search Mi Credit. Now, install the app.

2. Launch Mi Credit app and go through the welcome screen. After that, grant all the permissions.

2. Launch Mi Credit app and go through the welcome screen. After that, grant all the permissions.

3. On the next screen, tap on the Get Now button and provide your phone number. Now enter the OTP and proceed.

3. On the next screen, tap on the Get Now button and provide your phone number. Now enter the OTP and proceed.

4. Here, you will have to enter all the required documents. First, scan your PAN document and enter your details. After that, scan and enter your address proof document.

4. Here, you will have to enter all the required documents. First, scan your PAN document and enter your details. After that, scan and enter your address proof document.

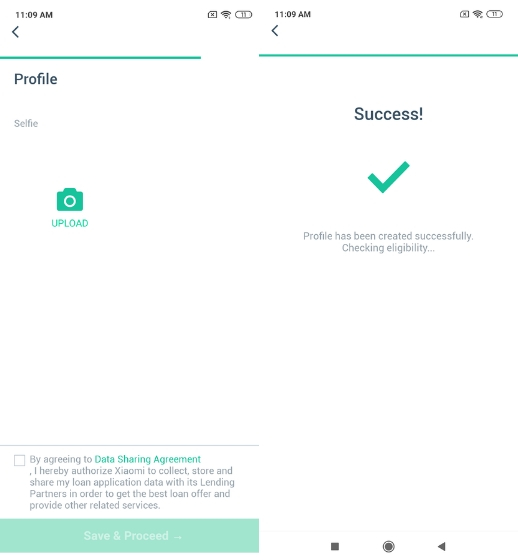

5. Finally, upload your selfie and then proceed. Your loan profile will be created and will be checked for eligibility.

5. Finally, upload your selfie and then proceed. Your loan profile will be created and will be checked for eligibility.

6. If you are eligible, it will let you proceed ahead with further documentation like bank account and salary details. After that, you will be able to initiate the disbursement directly to your bank account. In our testing, the system failed to find loan eligibility and suggested to re-apply after 60 days.

Mi Credit vs Other Instant Personal Loan Services

While Mi Credit is new and targeting its own set of MIUI users, the Indian market is flooded with digital lending services which can be availed by anyone with a steady source of income. Services like Indiabulls Dhani, KreditBee, and LazyPay are among the most popular choices for borrowers. In this section we will compare the new entrant, Mi Credit, to see where it stand against the competition.

Mi Credit Availability

In terms of availability, Mi Credit is available only to MIUI users which is a subset of Android users. KreditBee is also limited to Android only. Whereas, Indiabulls Dhani and LazyPay are available both on Android and iOS. As we can see, Mi Credit has a tough nut to crack if it limits itself to a closed ecosystem. The digital lending space is already filled with scores of players, and it will be better if Xiaomi opens up the service for everyone.

For testing purpose, we went ahead and extracted the Mi Credit APK from Redmi Note 7 Pro and installed the app on hosts of non-Xiaomi devices and it did pass through the installation. We installed the APK on Mi A1 running rooted Oreo, Redmi Note 5 Pro running custom ROM and Pixel 2 XL running Android Pie. On all the devices, we were able to register and proceed ahead with the documentation. To make things even more interesting, we found the mention of Google Play Store in the FAQ section of the app, so yes, Mi Credit is coming to all Android devices, but you will have to wait for the official release.

Note: If you wish to test Mi Credit on your non-Xiaomi device, you can download the APK from here. Do note that it’s a financial app so you should proceed with caution.

Mi Credit Interest Rate

In terms of monthly interest rates, Indiabulls Dhani charges interest from 1% to 3.17% with maximum tenure of 36 months; KreditBee interest rate ranges from 2% to 3% with a maximum tenure of just 6 months; and LazyPay charges interest from 1.25% to 2.3% with a maximum tenure of 24 months. As we can see, Mi Credit is better positioned here with 1.3% to 2.5% interest rates with 36 months of tenure. Nonetheless, Xiaomi has to fight these players with a low processing fee, and better customer service to create a loyal customer base.

Integration with other Services

Coming to tie-ups with e-commerce services like food delivery, taxi, and shopping, LazyPay wins hands down. It has integration with MakeMyTrip, Flipkart, Swiggy, BookMyShow, and other popular services. Whereas, Mi Credit, Indiabulls Dhani or KreditBee don’t offer any kind of pay later option with its line of credit. In the future, we hope Mi Credit expands its footstep and ropes in various services under its umbrella.

SEE ALSO: Here’s How to Get the Dark Mode in the Poco Launcher

Are You Excited about Xiaomi’s Mi Credit Service?

Mi Credit is an exciting product by Xiaomi and it has the potential to help out people in monetary need. The interest rates are similar to industry standards, but better customer service and no hidden charges will make it a preferable service just like its smartphones. At the moment, no company understands India better than Xiaomi given its growth in offline market and inroads into Tier II and III cities.

We hope Xiaomi continues to push the envelope and brings more Indian-specific products and services which can benefit the large pool of consumers. So do you like the new service by Xiaomi and how excited are you to use Mi Credit? Let us know in the comment section below.