Managing one’s finances can be one of the most crucial challenges one faces in his/her life. It is very important to keep a tight leash on your finances as it will help you to cut your undesirable expenses and increase your savings. You can try to do it manually by recording and keep track of all your bills and income sources, but that would be counterproductive, to say the least. One cannot possibly keep track of everything manually even if they wanted to. You need an app or a software which will help you do that. That is where personal finance software and services for Windows, macOS, Android and iOS, come to our aid. They not only help you track your monthly expenses, but also let you see your financial trends and forecasts, so that you can always remain on top of your finances. There are many good apps out there which will help you do that. We have rounded up the best of them, so, here are 10 best personal finance management apps you can use:

Note: These apps are in no particular order, read the descriptions to understand which is the best for you. Also, we have included both native and web apps in this list, as some of the best budgeting and finance services offer web apps instead of the native ones. It would be unwise to exclude them, as the list wouldn’t be complete without them.

Best Personal Finance and Budget Software

1. You Need A Budget

Budgeting is the most important thing one should do if he or she wants to keep their finances in check. It is always good to start the month knowing your fixed incomes and expenses. We all know that, but only a few of us really do proper budgeting. One reason behind that is the myth around the complexity of budgeting. Although budgeting is hard, it is not impossible to learn. You Need A Budget or YNAB makes budgeting even easier to learn and use. There are four basic rules YNAB tells you to focus on and let me tell you, if you do focus on these rules, you will have a much easier time living your life financially. We won’t get into details, as this is not the full review of the service but we will give an overview which will help see how easy and important it is.

So the Rule No. 1 is to “Give every dollar a job”. What that means is the moment you receive your income, every dollar should have a place to go to whether it be bills, shopping, fooding, expenses, health, or savings. This way all your important financial decisions are made at the start of the month and you never miss out on an important payment. The fourth rule is what is the essence of the whole budgeting exercise, “Age your money”. What this essentially means is that you should reach a point where every dollar you spend today should have been in your account since 30 days. Basically, you should be able to live on your last month’s income.

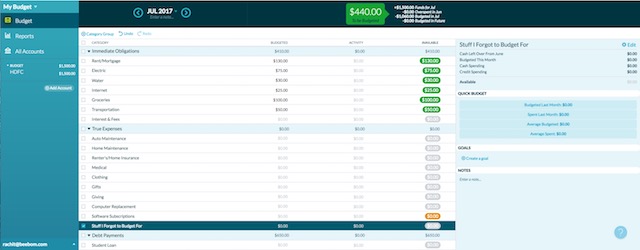

When it comes to the app itself, along with desktop versions, it has a web app which is supported by apps for iPhone, Android, Apple Watch, and even Alexa. The app’s interface is fairly simple. You can add your bank accounts which will automatically record your income and expenses or you can do it manually. There is a list of expenses, you assign your money to or you can create your own expenses. I like the feature which allows me to nest expenses under folders which allow me to similar expenses at one place. It also allows you to create auto bill pay functions which automatically pays your bills. It has many other functions but its best feature is that how easy it makes the whole budgeting experience. The app comes with a free 34-day trial, so you can try it out before buying.

Install: Web App, iOS, Android, Alexa, watchOS (Free trial, $50/Year)

2. Mint

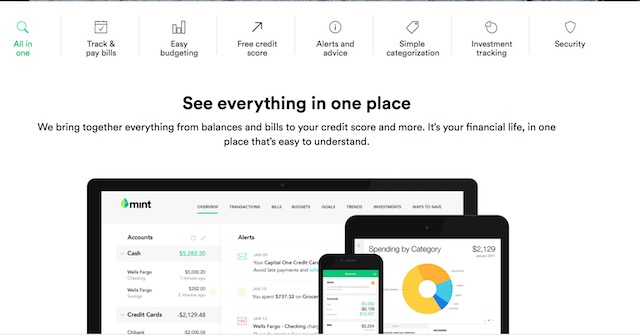

Mint in many ways is one of the first apps which really made personal finance management software really popular. It is packed with features which are supported by a UI that is both beautiful to look at and easy to learn and navigate. Mint basically claims to become the one-stop solution for all your finances. You can add multiple accounts and set it to auto populate the Mint. That way, everything is automatically updated on your Mint account without you having to strike a key. I love its smart recognition feature, which automatically categorizes your expenses based on your past habits. Like YNAB, it also has a web app for desktop, along with apps for Android and iPhone.

They have recently launched a service which allows you to see your credit scores for free, essentially allowing you to check your financial well-being as perceived by the banks at a click of the button. However, this feature is working for US residents only. Mint is the only finance manager app which is free and yet pretty trustworthy. The free to use aspect of Mint goes a long way, as many of the other apps on the list and financial software in general cost a lot of money. The only drawback of Mint is that the auto downloading of your bank statements can be finicky sometimes. Also, there are not a lot of features which will help you manage your investment accounts. Other than that, if you are looking for a simple finance manager app, this can be the one for you.

Install: Web App, Android, iOS (Free)

3. Banktivity 6

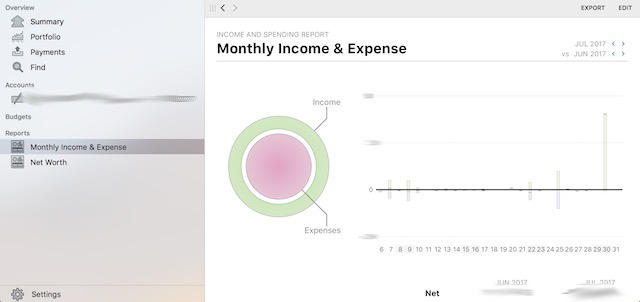

If you are looking for a full-fledged financial software which not only allows you manage your savings, expenses, and bank accounts but also helps you to manage your portfolio and other financial assets, Banktivity 6 is for you. Only available for Mac (including an app for iOS) right now, it is one of the most powerful finance apps I have ever used. It has loads of features which you can really figure out when you download and use the app. Because of that, it also has a bit of learning curve. But the time you spend configuring and learning Banktivity will not go in vain. It will allow you to keep a tight grip on all of your financial liabilities and income.

As other apps on the list, you can allow the app to directly download the data from your banks. With one click you can sync all your accounts in one place. Not only that you can also manage your stock-market portfolio here. It has an inbuilt budgeting tool which is quite advance allowing you to make your budgets with extreme precision. It also auto-generates weekly and monthly reports which are a great way to get a quick overview of your financial situation. The app is the quickest when it comes to syncing of your data. Since it is a full-fledged app on your Mac, it is also potentially a lot safer than the web apps on this list. The app is powerful enough to even handle the finances for small businesses you might own. This will be the only financial app you will ever require.

Install: macOS, iOS (Free trial, $64.99)

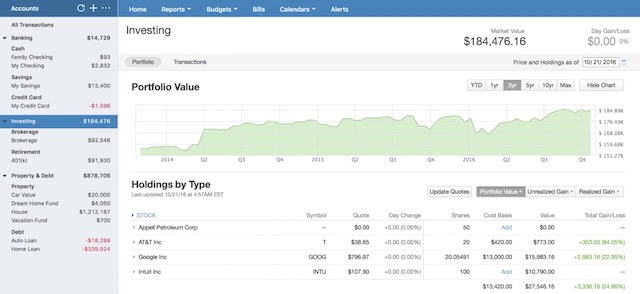

4. Quicken

It is sad that users which need the power and security of “Banktivity 6” cannot get it if they are using a Windows machine. This is where Quicken comes to their help. Quicken is for Windows what Banktivity is for Mac. Quicken is available for Mac users too along with mobile apps for iOS and Android. However, I have always preferred Banktivity on Mac. But that does not mean Quicken is any less powerful or secure. Choosing between the two services is basically comes down to personal preference and since Windows user cannot use Banktivity, Quicken becomes the king there.

Quicken does everything Banktivity does, including automatic account syncing, automatic expense tagging, managing portfolios, creating a budget, auto pay bills, and much more. The UI looks more modern than that of Banktivity as it uses more colourful graphs which are easier to decode. This feature alone makes it more useful to some users than Banktivity. Its overall cost is also lower than Banktivity. However, this one doesn’t come with a free trial, and you have to buy the app to use it. But, you will not be disappointed with your investment here. If you are looking for a strong finance management software for Windows PC, this is your best bet.

Install: macOS, Windows, iOS, Android ($64.99)

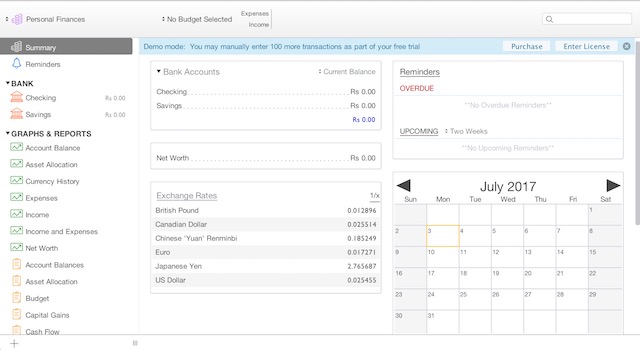

5. Moneydance

Moneydance is another great and powerful app which can act as an alternative for both Quicken and Banktivity 6 as it is available for both Windows and macOS along with an app for Linux. However, it does not have a mobile app for Android users. It has a simple ledger where you can manually create your entries, upload your bank statements, or allow it to access your account directly. I love its side calendar view which shows all the upcoming bills on their due dates. It is easier to see which bills are due when here than on any other app on the list.

However, by far its best feature is the Graphs. You can create graphs and charts for almost anything including separate graphs for your expenses, portfolios, asset allocations, currency history and much more. All the graphs can be created instantly and the fields are auto-populated without you having to do anything. You also get the ability to create your monthly budgets here. You can use the free trial to check out the app and buy the pro version if you like it.

Install: Windows, macOS, Linux, Android, iOS (Free trial, $49.99)

6. Pocketsmith

A direct competitor to Mint, Pocketsmith is an excellent web app which focuses more on the budgeting side of the things. Of course, you can import all of your transaction data to organise your expenses and stuff. But, where it outshines Mint is the enhanced budgeting tools it offers. You get the ability to create flexible budgets for each month. By far its best and most unique feature is financial forecasting. Based on your previous data, the app smartly forecasts the amount of money you will have on a certain date in a month. This really helps you in dealing with any unplanned expenses as you can literally see how much the new expense will impact your monthly budget at a glance. It has a free version but that only allows manual feeding of transaction data.

Install: Web App, Android, iOS (Free/$9.95/$19.95)

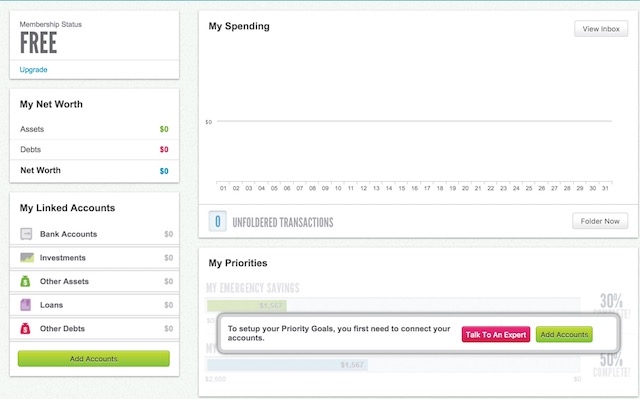

7. Personal Capital

Like Mint, Personal Capital is totally free to use and hence a direct competitor to it. It is also a web based app which focuses on managing your wealth by syncing your bank accounts, creating reports and budgeting. However, Personal Capital differs from Mint in a major way by focusing a lot more on the investment side of things. It is best suited for US citizens as many of its flagship features such as hidden investment broker fees, retirement forecasts are based on US financial rules and regulations. Hence, this one is best for anyone living in the US.

Install: Web App, Android, iOS (Free)

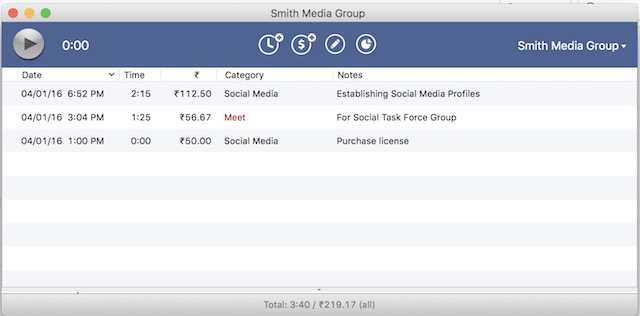

8. Office Time

This one is a little different and is not for everyone. This app is for freelancers or small business owners or contractors who billed their clients on an hourly basis. For these people keeping track of income is as important as the expense tracking. Office Time is by far the best software they can use. It not only tracks their time efficiently, it also allows them to raise invoices from right within the app. Whenever you are working it will show the money you have earned that session without having to do the calculation yourself. It is a must have app for people who are paid on hourly basis.

Install: Windows, macOS, iOS (Free trial/$47)

9. LearnVest

LearnVest takes a little different approach to financial management by bringing a human touch to the equation. What that means is that if you opt for the paid plans, you can make use of personal financial planner provided by the company. You can contact your planner through emails or request a call from them. Apart from that, the service is similar to Mint as in it is a web app which does everything that Mint does. However, it does not have an app for Android (only for iPhone). You can use the free version if you do not need the personal advisor but frankly, that is the only major difference this app offers over the others on this list.

Install: Web App, iOS, Android(Free/$299 one time payment +$19/month)

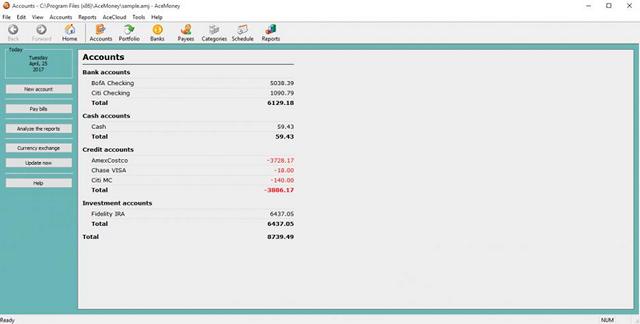

10. AceMoney

If you are looking for a cheaper alternative to Quicken or Banktivity for both Windows and Mac, this is the one for you. For almost half the cost, this one offers a similar feature set to both of them. However, this looks a little bit old as the UI seems pretty old. I would also like to point out that it crashed a few times during my review usage, however, I was using the trial version. You can do pretty much everything which by now we have to expect from a financial software, including multiple accounts management, expense tracker, bill auto-pay among others. If you are looking for a cheaper alternative, this might be the one for you.

Install: Windows, macOS (Free Trial / $39.99)

SEE ALSO: 10 Best Writing Apps For Mac You Can Use

Get On Top Of Your Finances With The Best Personal Finance Software

Managing your finances can be a pain, but yet this is one of the most important things you need to do. Manually keeping account of your finances is next to impossible, hence you need certain software which will help you do that. Most of the above mentioned apps have a free trial version, hence use them before making the decision and let us know which one did you decide to buy in the comments section below.