The International Data Corporation (IDC) has reported that global smartphone channels have yet again experienced a decline in shipments. The Global smartphone shipments in Q2, 2023 have declined by 7.8% on a year-on-year basis. Although, there’s hope for next year. Continue reading to know more.

International Smartphone Shipment Slowdown

This reported decline has resulted in the shipment of 265.3 million units. It isn’t new as the global shipment channels have been receiving this sort of blowback for the past eight quarters, including this one. On one hand, this indicates a soft market demand with rising inflation and a reduction in the purchasing power of consumers. On the other hand, this shrink is also indicative of the fact that the global market is stabilizing with increased opportunities for manufacturers to get rid of their excess inventory.

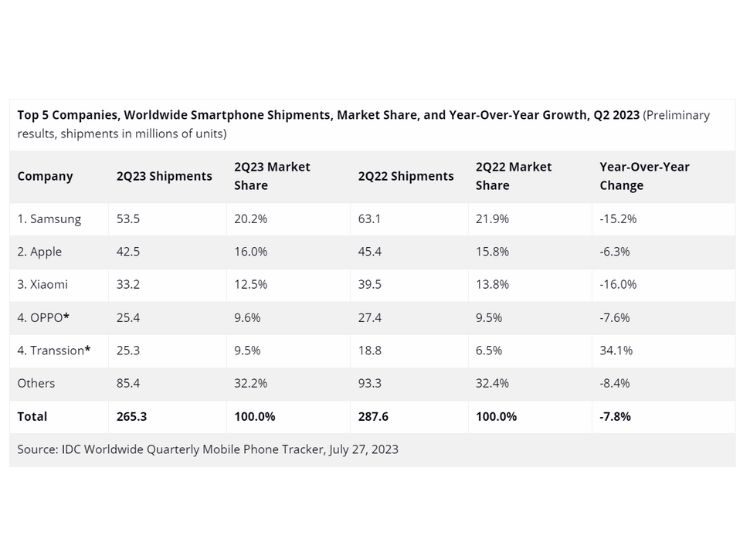

The biggest shrink in global demand has been experienced by Xiaomi at -16.0% followed by Samsung at -15.2% and Apple at -6.3%. China has also suffered a 2.1% year-on-year decline in Q2, 2023. Other major regions that saw contraction include the Asia/Pacific region (excluding Japan and China) at 5.9%, the United States and Europe at 19.1%, and the Middle East and Africa at 3.1%.

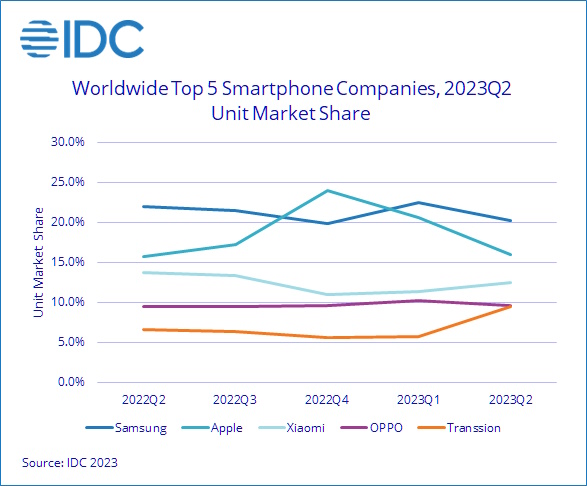

That said, Samsung has continued to stay at the top with a market share of 20.2%, followed by Apple (16% share), Xiaomi (12.5% share), Oppo (9.6% share), and Transsion Holdings (9.5% share).

Plus, there’s still hope on the horizon as the shipments are expected see to growth by the end of this year and in 2024. The foldable smartphone market is also projected to see a 50% growth this year.

Nabila Popal, the Research Director with IDC’s Mobility and Consumer Device Trackers commented on the decline saying, “The good news is that inventory levels are improving and the latest market chatter suggests that by Q3 excess inventory in finished devices and components should clear up. As inventory levels normalize, we are finally hearing optimism from key OEMs and supply chains and expect the market to return to growth by the end of the year and into 2024. As the market ramps back up, it is also an opportunity for vendors to gain a share. IDC expects a shift in the vendor rankings at the bottom of the stack, as we already see happening this quarter with Transsion entering the Top 5 for the first time.“

So, what do you think? Do let us know your thoughts in the comments below.