- EA confirms a $55 billion deal to go private in one of the biggest buyouts ever in the entertainment and video games industry.

- The acquisition is backed by PIF, Silver Lake, and Jared Kushner's Affinity Partners.

- Andrew Wilson stays on as CEO while EA exits public trading after 36 years.

If you are familiar with EA’s sports games and their campaign, you must be familiar with the quote, “Welcome to the Next Level.” Well, that seems true now. EA has officially agreed to a historic $55 billion acquisition that will take the company private.

The news first leaked last week when we covered the reports of EA being in talks of a $50 billion deal to go private. Electronic Arts is one of the most popular names in the industry, being a giant publisher for delivering classic franchises like FIFA, The Sims, and Battlefield. This is one of the largest leveraged buyouts ever in entertainment. It is being led by Saudi Arabia’s Public Investment Fund (PIF) alongside private equity giant Silver Lake and Jared Kushner’s Affinity Partners.

EA Goes Private but Andrew Wilson Stays in the Game

As per the official terms of the agreement, EA shareholders will receive $210 per share in cash, a 25 percent premium over its pre-rumor price. The investors value the deal at $55 billion, including debt, with $36 billion in equity commitments and $20 billion in debt financing led by JPMorgan. PIF, already EA’s largest insider stakeholder with a 9.9 percent stake, will roll its shares into the new structure.

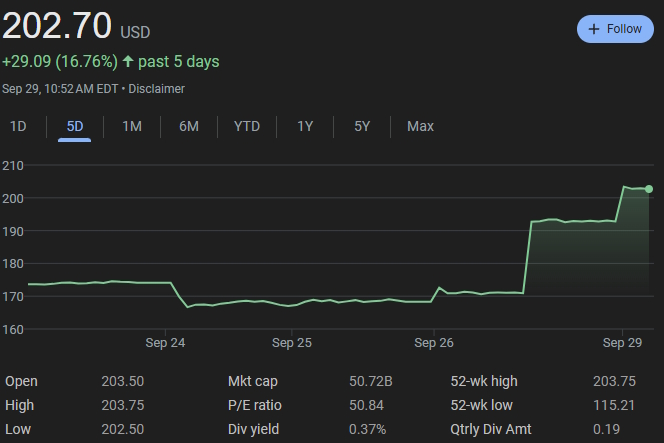

This is in line with PIF’s aggressive push into gaming, which has included minority stakes in Nintendo, Capcom, and Take-Two, along with major purchases like ESL, FACEIT, and Scopely through its Savvy Gaming Group. Analysts note this deal marks the biggest single leap in that strategy to date. Since the rumors last week, the company has already received positive numbers in the market, with the graph going in an upward green peak.

The transaction closure is expected as early as the first fiscal quarter of 2027. After that, EA will end its 36-year run as a publicly traded company. The company headquarters will be in Redwood City, California, with Andrew Wilson staying as CEO. Wilson has been in the top role since 2013. So, consider games like EA Sports FC 26 (review) or Battlefield being in the same hands.

The deal eclipses the record $32 billion TXU buyout in 2007, underscoring the scale of global capital now flowing into gaming. For EA, going private removes the pressures of quarterly earnings, potentially giving it more creative breathing room. However, it comes with $20 billion in debt attached, and cost-cutting could follow. More layoffs from EA? (as if it weren’t happening.)

In a statement, Kushner praised EA’s legacy of creating “iconic, lasting experiences.” Moreover, PIF described itself as uniquely positioned to expand EA’s global reach. Wilson framed the buyout as recognition of EA’s teams and their impact on hundreds of millions of players.

If completed, this acquisition will cement gaming as one of the crown jewels in Saudi Arabia’s diversification push. And as we said, EA will welcome the whole video games industry to a new era.